The current state of the economy and rising tuition costs have forced many students to live off of student loans while they pursue higher education.

Last month, Sallie Mae announced new enhancements to its Smart Option Student Loan program for the upcoming 2010-2011 school term. Cutting interest rates, the Smart Option Loan will range between 2.88 percent and 10.25 percent.

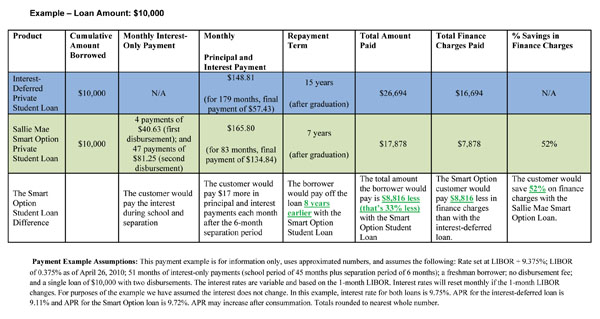

The Sallie Mae Smart Option Loan could save you money over time, requiring interest-only payments both during school and during the normal six-month grace period after you finish school. Making these payments early could be the difference between reaching financial independence in your late twenties or mid thirties. The chart below is an example of cost saving benefits to students over the life of their loan.

Unlike some credit programs, there is no early repayment penalty or prepayment penalty, meaning you are free to pay more than you owe each month. This expedited payment structure also means larger payments per month once you begin repayment on your loan.

In a press release, Executive Vice President of Sallie Mae Joe DePaulo said: “Our experience shows that our student customers are successfully managing their monthly payments. In fact, customers who selected Sallie Mae’s Smart Option Student Loan over the last year and continue to make on-time payments are on track to save an estimated $1.1 billion in total over the life of their loans. As the economy improves, we are pleased to pass additional savings on to students and families and encourage them to borrow smart.”

Other benefits, like the UPromise Rewards program and a 0.25 percent interest rate reduction with a debit payment plan, come standard on all Sallie Mae loans.

For more information on the Sallie Mae Smart Option Student Loan, click here.